Now in my 40th year of being a geologist, it seems a perfect time to reflect on a career that has navigated resource industry booms and busts, and the change in focus from different commodities that I’ve worked across within that time.

In 1983, I graduated from a university in Ballarat, a rural city 115 kilometers west of Melbourne, Australia. Ballarat is famous for its gold rush days from 1851 to the late 1860s and, as such, its geology degree is very gold and base metal focused.

After graduating I was now, by default, a “hard rock” geologist and, for the next 20 years, I worked in the minerals industry as a contract geologist, working on drilling campaigns for many different commodities, such as gold, copper, silver, lead, zinc and uranium.

There are two very broad fields of economic geology: “Hard rock,” which covers deposits of base metals and precious metals that are generally associated with volcanic activity (hard rocks), and “soft rock,” which covers oil and gas, and coal, which are associated with sedimentary rocks. Most geologists spend their entire careers working in the fields they first started in, very rarely crossing over to the other – and for good reason. There’s very little knowledge base that crosses over from one to the other, especially at a senior level in each field. If you wanted to change fields, then you really had to start at the bottom and work your way up again – and this is exactly what I did.

After 20 years of working in minerals, I decided I wanted a change and took the steps needed to get a role working in offshore oil and gas. I knew I would have to start at a very beginner level, both in experience and pay levels, but decided to give it a go. Despite being told by many people that it’s impossible to go from working in minerals to working in oil and gas, my research and tenacity paid off and within 12 months I was starting my first four-week hitch on an offshore jack-up rig as a mudlogger.

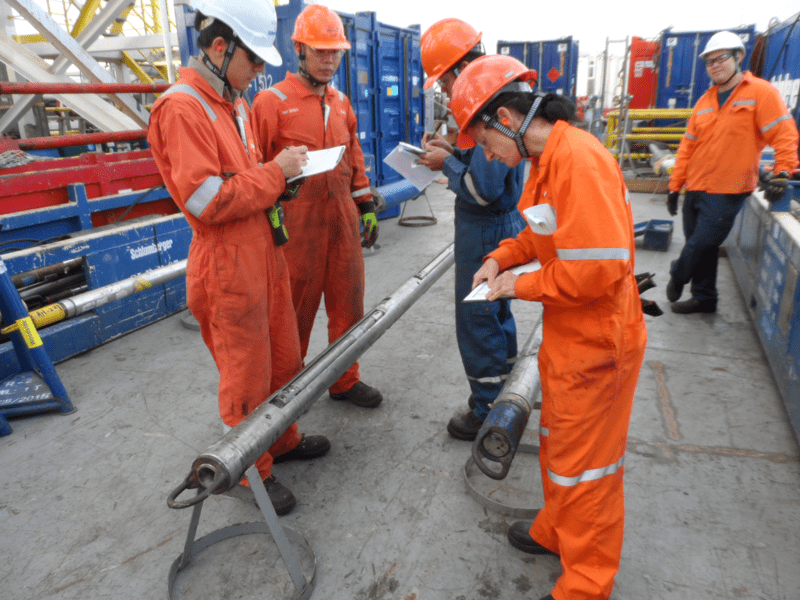

Working as a mudlogger is the most common starting point for any geologist who wants a career working in offshore drilling operations and, because I had no aspirations of becoming an office-based petroleum geologist, I knew this was a role I had to commit to in order to continue working offshore.

For the next few years, I worked on offshore oil rigs as a mudlogger in Australasia and the U.K. This role gave me a comprehensive overview of offshore drilling operations, as well as an understanding of petroleum geology, which was something I learned very little about during my hard rock-centric geology degree.

The costs and technology involved in drilling offshore oil and gas wells is on a completely different level to that of mineral drilling. The most mind-blowing difference is the cost of collecting the subsurface data that drilling enables you to acquire. While an exploration mineral drilling “hole” can cost several thousand dollars to drill, an oil and gas “well” can cost tens of millions of dollars to drill. I was once on a well that ended up costing over $120 million, with cost overruns occurring due to a structurally difficult formation and many sidetracks required to get to the subsurface target zone. Given the enormous costs involved, it’s easy to see why oil and gas exploration drilling campaigns are the first victims of budget cuts when a cyclical downturn hits the industry.

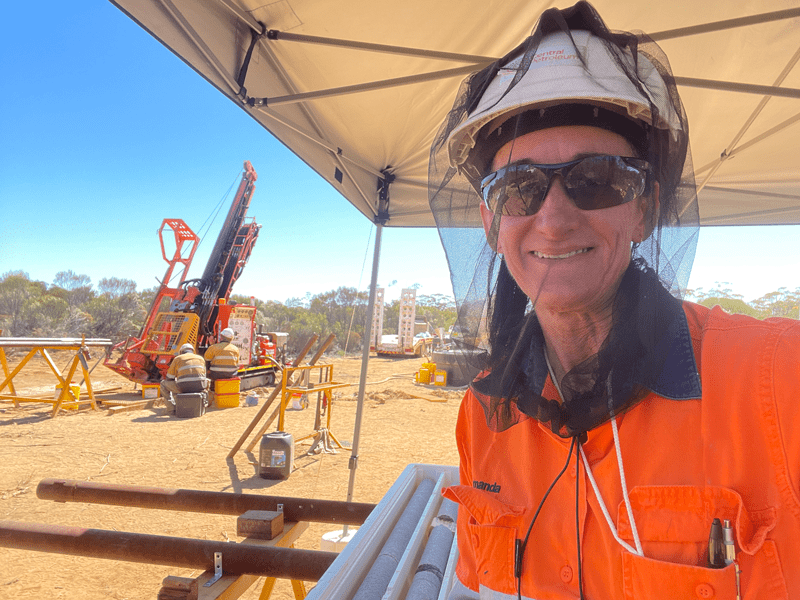

Family commitments eventually saw me working back in the minerals industry due to the need to be home every night, and I worked on a mine site development drilling campaign with an 80 kilometer drive to work and back, five days a week. My previous experience prior to working offshore meant I was easily able to rotate between the two different industries this time, and it was a seamless transition.

I worked back in base metals near-mine drilling operations for the next few years, eventually being able to resume working in remote locations on a “fly in/fly out” (FIFO) rotation as at-home family commitments lessened with once-dependent kids becoming less so.

In June of 2008, I started a new role on a mine extension feasibility drilling campaign at a silver-lead-zinc mine. The scope of the drilling campaign was enormous and several rigs were contracted to start the resource definition drilling. Engineers and geologists in the mine technical services department joked about assigning any costs you wanted for fictitious miscellaneous luxuries to the cost code of this drilling campaign because the funds being allocated to it were enormous.

I’m sure you can guess how this job ended. By mid-2009, the global financial crisis had killed every dollar of exploration and mine extension drilling budgets and all that was left was a nasty legal battle between the mining company and the drilling contractor company for compensation for several rigs that were acquired for the campaign and were no longer needed.

This experience taught me a valuable lesson: When money is flowing so freely into the industry and everyone thinks the good times are never going to end… then they are probably about to! (A lesson I was later to learn also in the oil and gas industry.)

So, once again, I was looking for a change and it came very soon after meeting with a geologist friend whom I worked with years before as a mudlogger offshore. He was now an operations geologist for a locally based oil and gas company that was drilling development wells in the then-fledgling coal seam gas industry. My mudlogging skills of sample descriptions and knowledge of gas drilling operations were well suited to the role, so I started within a few weeks of getting made redundant at the silver-lead-zinc mine.

This wellsite geologist role soon made me hungry to return to an offshore role as a wellsite geologist (WSG), so I undertook further courses in operations geology and petrophysical well log interpretation to give me more skills that I knew would be required before I would be considered for a WSG role offshore.

By 2012, an oil and gas boom had well and truly been established and the skills shortage that always accompanies any industry boom meant this was the perfect opportunity for less experienced people to get their foot in the door. After spending the previous couple of years acquiring new targeted knowledge and tenaciously increasing my network of offshore connections, I finally secured my first job as an offshore wellsite geologist!

After a decade of working offshore as a WSG and riding the oil and gas boom wave, the cycle eventually did the 180 degree turn and dumped me again, just like it had in 2009.

Both the minerals and energy sectors started to experience extreme disruptions due to the hysteria that the green energy activists were whipping up globally, in particular within political circles. There was a crazy notion that the sun and wind could magically create electricity to power the world with no need for minerals or fossil fuels.

What was conveniently overlooked was the extreme mined resources that are needed to service the booming electric vehicle (EV) revolution, and the upgrade to the power grid that would be needed to convert the world to electrically powered everything – from cars, trucks, ships and planes to simply cooking meals and staying warm in winter and cool in summer in our homes. The rapid expansion of wind farms and solar panels for electricity generation soon exposed the overlooked fact that all these “green energy” sources require extensive supplies of natural resources, which, in turn, also required enormous amounts of fossil fuel-powered energy to mine and process them. The “No Fossil Fuels” and “No Mining” activists seemed to be completely ignorant of how wind turbines and solar panels are actually made.

And that brings us to the exciting part of my career story… The underinvestment in both the energy and minerals sectors over the past decade is now catching up to the industrialized world and acute shortages of both are about to create the biggest resources super cycle boom probably of my lifetime.

For the past year and a half, I’ve been working back in the minerals industry, working on a resource definition drilling campaign at a copper-gold mine. With gold prices recently hitting all-time highs, it’s easy to get excited about the career opportunities for a new wave of geologists. This is the time where opportunities present themselves and doors that have been long shut finally open again.

The offshore oil and gas industry, particularly in Australia, continues to be hampered by regulatory red tape and negative sentiment, which has prevented me from returning to this industry for now, but it’s only a matter of time before crunch time comes for energy supply in Australia and the politicians realize their short-sightedness has created critical electricity supply deficits country-wide. And then the investment money will start flowing into the oil and gas sector again as the panic to curb skyrocketing electricity bills becomes a priority for politicians.

In an endless rotation of supply and demand cycles, I don’t recall there ever being a time of such undeniable misinformation that has resulted in the dire underinvestment in commodities like we’re seeing now. We’re looking at a resources bull market based on a decade of underinvestment due to misguided information about what is needed to transition to a “green energy” future with zero carbon emissions, and in the process, demonizing fossil fuels.

Having extensive experience in both mineral drilling and oil and gas drilling campaigns, there’s never been a more exciting time to be a geologist! Without even consciously being aware of it, I have managed to customize my geology career progression to maximize my opportunities in the energy transition pathways in the coming decades. I’m glad I didn’t listen all those years ago to the naysayers who told me you can’t swap from minerals to oil and gas!

Amanda Barlow is a contract geologist whose 35+ year career includes working within the offshore oil and gas, coal seam gas and minerals industries.

Barlow is also a recreational marathon runner and a published author of three books. She has run 45 marathons in 18 different countries around the world, including the Jungle Marathon in Brazil, which is chronicled in her first published book, Call of the Jungle – How a Camping-Hating City-Slicker Mum Survived an Ultra Endurance Race Through the Amazon Jungle.

Her second book, An Inconvenient Life: My Unconventional Career as a Wellsite Geologist, documents her 35+ year career as a geologist and how she ended up working as a wellsite geologist on offshore oil and gas rigs.

Offshore Oil and Gas PEOPLE: Overview of Offshore Drilling Operations is Barlow’s third book and an overview of what it’s like to work on an oil rig, and the role everyone plays.

She can be contacted through her LinkedIn profile.

Oil and gas operations are commonly found in remote locations far from company headquarters. Now, it's possible to monitor pump operations, collate and analyze seismic data, and track employees around the world from almost anywhere. Whether employees are in the office or in the field, the internet and related applications enable a greater multidirectional flow of information – and control – than ever before.